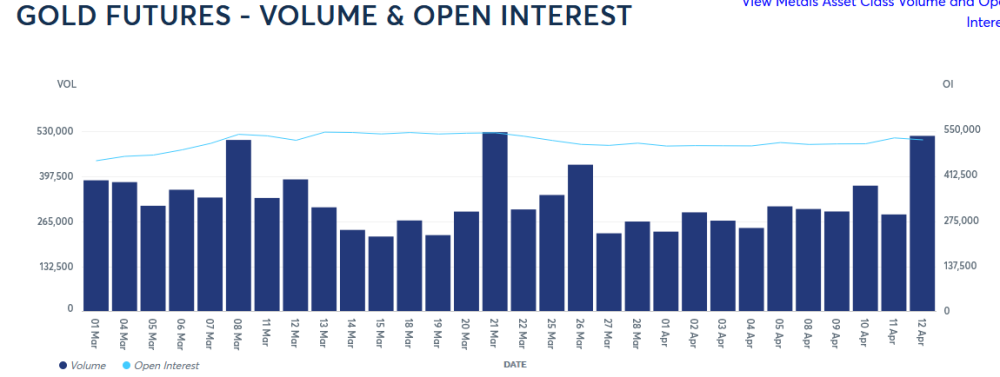

Gold is having a strong run, and a pause, consolidation, or correction is healthy. It looks to me that we have a short term top with a spike close to $2,400 on higher volume than recently.

We are in uncharted territory, so one never knows if we just go back up on Monday, but I am expecting at least a consolidation like we saw back in March. Open interest is flat and still lower than in March. So, there is no real buying coming into Comex Gold; this is mostly short covering on the Comex so far.

The strong physical demand from Central Bankers and numerous other venues is driving this market rally. I believed it would take a price of $2,300 and higher to attract buying in this market, but so far, there has been hardly any interest in this gold rally. Open interest is not rising on Comex, and there are no flows into precious metals ETFs or the precious metal stock ETFs. The gold miners have rallied some, but they remain cheap and barely keep up with gold. In more normal times, they would outperform gold, and eventually, they would.

This is all good news because it means there are tons and tons of buying on the sidelines. It appears that investors are frozen like a deer in the headlights. They don't seem to believe the rally. I think. one reason is they have been brain washed by the narrative that gold should not be going up until the Fed pivots and starts lowering rates. Most are clueless, and gold is rising as the US$ is rising, so that does not fit their narrative either.

The market has changed, and the masses haven't gotten it yet. This is our advantage because we are in the know, way ahead of the crowd.

This chart compares gold SPDR Gold Shares ETF (GLD:NYSE) to four gold stock indexes since the bottom in October 2022. You can see that only VanEck Junior Gold Miner ETF (GDXJ:NYSEArca) is slightly ahead of gold, while the others are still below. Note that the volume into GLD is nothing spectacular, either. The rally in gold stocks has barely begun.

The Shanghai exchange is becoming more influential, with 6,962 tonnes of gold traded in March compared to Comex, with around 19,000 tonnes. The huge difference is Shanghai is practically all physical gold, while Comex is practically all paper gold.

China keeps buying physical gold, but Comex Gold is non-Basel III compliant; it is strictly a paper market. However, London is compliant, so physical buyers are using Comex gold contracts to take delivery by having it transferred (EFP it) to London, which is Basel III compliant, and a few days later, get their actual physical gold at small premiums.

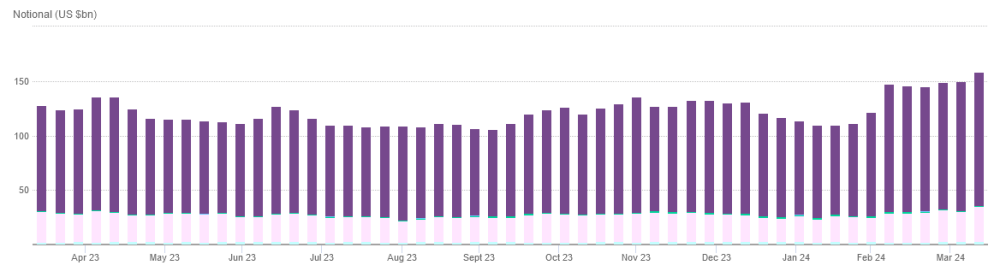

Shanghai also has a Gold Futures exchange, and it is not nearly as dominant in paper gold as Comex. This chart is open interest on the nine major gold exchanges but it is pretty well dominated by Comex (purple) and Shanghai (pink). There has been virtually no increase in open interest. This chart reflects the $ value, so the increase you see is mostly related to the increased price of gold.

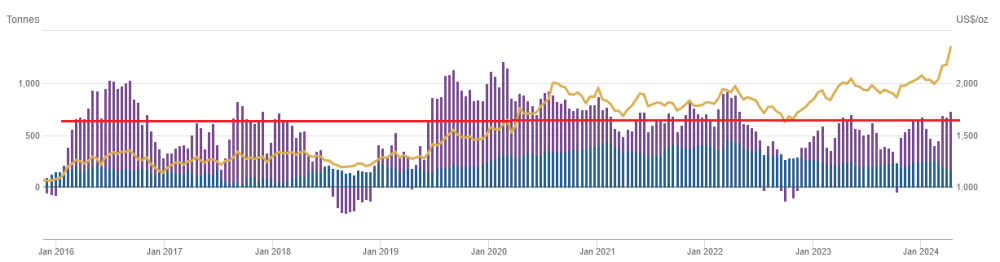

The next chart shows the net long positions on Comex and the gold price. It is obvious there has been little buying so far.

Note my red line for reference, as there were way more long positions in the 2016 and 2020/21 bull moves.

Gold is rising against all currencies and, more so, other than US$. The currencies of G20 countries are almost all depreciating against the dollar.

The decline since the beginning of the year has reached 8% for the yen and 5.5% for the South Korean won, led by the Turkish lira at 8.8%. Both developed and emerging economies have seen currencies weaken at an accelerating pace, with the Australian dollar, Canadian dollar, and euro falling 4.4%, 3.3%, and 2.8%, respectively, in developed economies. China has been accumulating physical gold for over a decade. They are the largest producer and keep all that in the country, too. We have reached the point where control of the gold price has moved to China and the East.

Meanwhile, in the U.S., the interventions, deceptions, and manipulation of data have gone to new levels under the Biden Administration. Headline job numbers get really inflated with seasonal adjustments and such and then quietly revised lower in the months ahead. They show lower than real inflation numbers to keep the pivot narrative alive with the intent of holding stock markets up and economic hope. Take last week's Producer Price Index (PPI) report as another prime example.

PPI unexpectedly missed expectations on the headline level, coming in at 2.1%, despite being the hottest since April 2023. With the core number (excluding food and energy), according to the BLS, the only reason PPI was even positive in March is because of services, where the biggest source of upside was the "index for securities brokerage, dealing, investment advice, and related services, which rose 3.1%." That means there was a push to open a brokerage account to trade stocks and Bitcoin ETFs.

I would have expected the big thing to increase was gas prices. Just recently, in my Silver Breakout Imminent report, I showed a big increase in gasoline prices. They are up +18% in 2024 and about 5% from March 2023, but low and behold, according to Biden's Bureau of BS "leading the March decline in the index for final demand goods, prices for gasoline decreased 3.6%."

How can that be? Well, it is their favorite trick of propaganda called "seasonally Adjusted." I might understand this if it was summertime when gasoline prices typically rise, but March is barely past winter. The seasonal adjustment is simply a manipulation tool. CPI numbers were a bit high, so they next brought out the PPI report next a bit low to keep the lower interest rate narrative alive. Remember, 'Fed Speak' can mean more than reality to markets.

The HUI gold bugs index has a higher high, breaching my 260 targets, but as I have said, I think we need 300 on the index to start waking the gold stocks up.

The TSX Venture is showing slight signs of life. Rumour has it that a pulse has been detected. I believe we need a break above 660 to get some interest back. Volume has picked up ever so slightly, with volumes a little above 20 million in the last two months instead of below 20 million. At least the uptrend in prices is still alive. There is the odd junior here and there coming off of bottoms.

I will soon plan an update on oil and gas and our stocks in that sector, but for now, a quick update on Nektar.

Nektar

Nektar Therapeutics (NKTR:NASDAQ)

Recent Price - $1.62

Entry Price - $0.68

Opinion – hold, target $2.00 to $2.50

I was contemplating selling Nektar Therapeutics (NKTR:NASDAQ) this week, but the chart has convinced me otherwise.

Many times, I have highlighted how a stock will move and fill a gap, either to the upside or downside and such is the case with NKTR.

The stock has broken up into the gap and should go higher to fill it.

There is some resistance around $2.30, so we will see how the stock is trading when it gets up around $2.00. The stock is now trading around cash value, and it deserves a slightly higher valuation than that.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Ron Struthers: I, or members of my immediate household or family, own securities of: SPDR and Nektar. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

- This article does not constitute medical advice. Officers, employees and contributors to Streetwise Reports are not licensed medical professionals. Readers should always contact their healthcare professionals for medical advice.

For additional disclosures, please click here.

Struthers Resource Stock Report Disclosures

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.